SUMMARY

A globally diversified, core investment portfolio has helped some families preserve and grow wealth for generations. We explore the principles and practices involved in building such an allocation.

Great wealth has seldom stood the test of time.

Of the families that made up the world’s wealthiest several generations ago, few remain among their number today. And yet, a minority has managed to keep their place. How have they achieved this?

At Citi Private Bank, we have worked with numerous families who have preserved and grown their wealth over generations. In doing so, they have left little to chance.

Instead, they have typically adopted a farsighted and disciplined approach to their business operations, preparing their successors and structuring their wealth. They have also built core investment portfolios, which they have maintained for the long term.

What is a core portfolio?

A core portfolio is a carefully selected, long-term mix of investments. Based on an individual investor’s objectives and risk tolerance, it can be drawn from different asset classes globally. Its goal is to preserve and grow wealth over time.

A core investment portfolio can often account for most of a family’s wealth aside from their business holdings, homes, art and other collections. For families whose businesses account for a significant part of their total wealth, a core portfolio can help diversify the risk of a highly concentrated holding.

A guide to building a core portfolio

Behind every core portfolio that has preserved and grown wealth over time is a carefully considered plan. This all begins with setting out the family’s goals, investment objectives, risk tolerance, time horizon and other circumstances. Based on this, a strategic asset allocation – or long-term investment plan – can be created.

The plan describes a customized mix of asset classes: equities, fixed income and cash. For suitable and qualified investors, it may also include private equity, real estate and hedge funds.

At Citi Private Bank, we determine how much of each asset class to hold based on the outlook for returns and risk, as well as the client’s investment objectives and risk tolerance.

Adding diversification to a portfolio

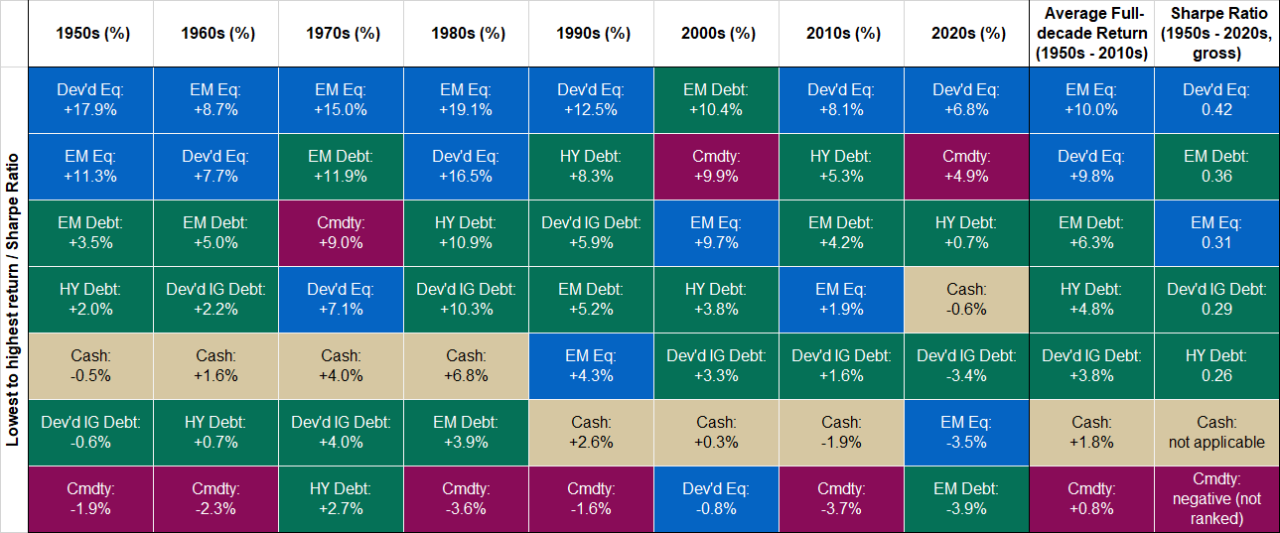

Diversification is a powerful force. Figure 1 shows the performance of major asset classes since 1950.

No single asset class consistently outperformed in every decade. This speaks to the potential for constructing portfolios that combine multiple asset classes to seek improved risk-adjusted returns.

Figure 1. Asset class returns and risk adjusted returns by decade

Source: Citi Wealth Investment Lab as of November 2023. For discussion purposes only. Data assumes the reinvestment of dividends. The historical analysis uses benchmark indices to proxy for each asset classes. Please see the appendix glossary for index definitions. Indices are unmanaged. An investor cannot invest directly in an index. Past performance is no guarantee of future results. Real results may vary. Performance is gross of fees that may be charged. All performance information shown above is historical , not the actual performance of any client account. Diversification does not ensure profit or protection against loss. Dates until October 31 2023. Sharpe Ratio is a measure that compares the returns on an investment to its risk as measured by its volatility.

As well as diversifying by asset class, prudent investors have diversified by geography and sector.

Holding assets from around the world may be useful when certain regions experience higher growth than others.

And during the regionally focused crises of the past quarter of a century, markets elsewhere in the world have often been more resilient, helping to mitigate global investors’ risks – figure 2.

FIGURE 2. GLOBAL MARKETS MAY HOLD UP BETTER DURING REGIONALLY FOCUSED CRISES

Regional crisis |

Return during first year of crisis (%) |

|

|---|---|---|

Asian crisis 1997 |

Asia equities -28.30% |

Global equities 15.00% |

Latam crisis 1998 |

LATAM -35.10% |

Global 22.00% |

EU crisis 2011–2013 |

Europe -10.50% |

Global -6.90% |

Commodity collapse 2015 |

LATAM -30.80% |

Global -1.80% |

US/China trade war 2018 |

China -18.70% |

Global -8.90% |

Average |

-24.70% |

3.90% |

Source: Bloomberg as of March 2023. Please see Appendix Glossary for index definitions. Indices are unmanaged. An investor cannot invest directly in an index. Past performance is no guarantee of future results. Real results may vary. Diversification does not ensure profit or protection against loss.

The same is true of diversifying by sector. Basic materials and healthcare, for example, may perform better at different stages of a market cycle. As a result, they may complement each other in a broadly diversified core portfolio.

Why portfolio diversification matters

Wealthy families whose wealth has endured have almost invariably harnessed the power of global, multi-asset class diversification. For example, they look to higher quality bonds such as US Treasuries to help seek risk mitigation amid bouts of equity market turbulence – figure 2. Many have allocated to gold, which has often strengthened during moments of crisis when equities have fallen.

Of course, these assets come with risks of their own. Treasuries tend to lean toward market value losses as interest rates rise. Their returns can be eaten away by inflation over time. Gold, meanwhile, is often volatile, pays no dividends and indeed incurs ownership costs. The yellow metal suffered sustained price weakness between 1980 and 1999.

FIGURE 3. US TREASURIES AND GOLD HAVE OFTEN SHOWN NEGATIVE CORRELATION TO EQUITIES DURING STOCK MARKET DOWNTURNS

| Market Situation** | Start date | End date | Defined period total return | ||

|---|---|---|---|---|---|

| S&P 500 Index | U.S. Treasuries | Gold Price Return | |||

1987 crash |

25/08/1987 | 19/10/1987 | -32.93% | -2.60% | 5.02% |

Russian default & LTCM collapse |

20/07/1998 | 08/10/1998 | -18.66% | 5.27% | 1.18% |

Terrorist attacks of Sept. 11th |

10/09/2001 | 11/10/2001 | 0.59% | 1.53% | 3.50% |

Global Financial Crisis |

11/10/2007 | 06/03/2009 | -54.46% | 15.80% | 25.61% |

2010 Euro zone crisis and flash crash |

20/04/2010 | 01/07/2010 | -14.53% | 4.47% | 5.08% |

U.S. sovereign debt rating downgrade |

25/07/2011 | 09/08/2011 | -12.27% | 3.64% | 7.86% |

“Taper Tantrum” |

22/05/2013 | 24/06/2013 | -4.81% | -1.97% | -6.41% |

China growth concerns |

18/08/2015 | 11/02/2016 | -11.85% | 3.50% | 11.54% |

Covid 19 Sell-off |

19/02/2020 | 23/03/2020 | -33.79% | 5.40% | -3.63% |

2022 downturn |

01/01/2022 | 31/12/2022 | -18.13% | -12.46% | -0.28% |

Source: Bloomberg as of February 2024. Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment. Index returns do not include any expenses, fees or sales charges, which would lower performance. Diversification does not ensure profit or protection against loss. Past performance is no guarantee of future results. Real results may vary.

There may be potential benefits of alternative investments for suitable investors

For suitable and qualified investors, alternative assets can provide further potential portfolio benefits as well as risks over a longer duration. Thoughtful allocations to private equity, real estate and hedge funds may provide additional diversification and sources of return that don’t correlate to the public markets.

Certain types of hedge fund strategies, for example, seek returns from episodes of market turmoil, while others position to earn returns irrespective of the markets’ broad direction. Despite their potential to seek above-average returns, alternative asset classes come with many risks, some of them unique.

They are speculative and entail significant risks that can include losses due to leveraging or other speculative investment practices, lack of liquidity, volatility of returns, restrictions on transferring interests in the fund, potential lack of diversification, absence of information regarding valuations and pricing, complex tax structures and delays in tax reporting, less regulation, and higher fees than mutual funds and advisor risk.

Staying the course

There is a widespread belief that families who have remained among the world’s wealthiest over time must have done so by sidestepping financial market crises along the way.

The implicit assumption is that certain investors would have to have nimbly liquidated their core portfolios ahead of the worst turmoil and later bought back in at bargain prices. However, staying fully invested in various asset classes can be worthwhile, as shown by the multi-year illustration in figure 1.

Rather than catching uptrends and avoiding downtrends, by contrast, investors who try to time the markets have all too often ended up missing the early bull market rallies. Forgoing such potential returns can hinder returns over time.

Over time, bull markets in equities have been longer and larger than bear markets, even if their timing has been unpredictable. This emphasizes the case for staying invested through the good times and bad.

What diversification can seek to add to core portfolios

Seeking to preserve and grow wealth over time is ultimately about discipline.

This involves establishing careful plans according to objectives and risk tolerance, implementing them over the long term, reviewing and then adapting them as circumstances change.

These disciplines apply when it comes to operating businesses, creating multigenerational wealth plans, preparing heirs and building core investment portfolios. While there are no guarantees of success, long experience suggests it may be possible to increase the chances.

If you would like to discuss your core portfolio, please contact us.