SUMMARY

Big price falls in 2022 have left preferred securities looking attractively valued, in our view. We are positive on their prospects for 2023, despite recession risks.

Bonds are back.

After a terrible year in 2022, we believe that fixed income once again offers the potential for attractive returns. The reason? Yields have risen and valuations have cheapened, while inflation is moderating.

However, we’re also emphasizing selectivity within this asset class. Among the assets we favor are preferred securities.

What are preferreds?

Before we delve into why, here’s a quick refresher on preferreds. (Seasoned preferred investors may want to skip this bit.) Preferred securities are sort of a hybrid between bonds and equities.

Sometimes, preferred prices show heightened sensitivity to changes in interest rates. Other times, they can appear to follow the direction of equity markets. Banks, utilities and insurers are among the most frequent issuers of these securities.

Preferreds typically offer somewhat higher yields than straightforward bonds but also come with different risks. One of these is subordination risk. If the issuer of a preferred becomes insolvent, preferred holders stand in line behind the owners of senior debt for getting any money back. However, preferreds rank ahead of ordinary stockholders, but don’t have voting rights.

Some preferreds pay fixed coupons. Others have variable-rate coupons that can float with short-term interest rates (such as SOFR) or that can reset at the going level of Treasury yields

Whether fixed or floating, the majority of preferreds issued over the last decade have coupons considered “non-cumulative.” This means that if the issuer suspends dividends but later resumes, there is no requirement to pay preferred investors what’s been missed.

Other older preferred structures are cumulative, such that issuers do have to make up for what they’ve missed.

Like common equity, most global preferred securities do not have a maturity date. However, all preferreds come to market with an option for the issuer to repay investors’ principal back to them on a preset “call date.”

Our preferences in preferreds

Following a rocky 2022, preferreds have had a strong start to the New Year.

Performance has obviously varied by security, but on average, the market has gained between 5-10% through 31 January.

Despite the rally, preferreds still yield between 6.5% and 7.5%, on average. That’s about 350 basis points (bps) higher than a year ago.1

What’s more, that yield is roughly 200-300bps higher than what you might earn on long-dated US Treasuries. From a valuation point of view, we believe this represents an attractive entry point.

Of course, some preferreds yield more or less than others. For example, high-quality US banks are likely to sport yields near the bottom of the aforementioned range. But more cyclically sensitive non-financial preferreds – such as consumer finance or automotive finance companies – may offer yields well north of 8.0%.

As to region, higher yields are to be found in Europe. After all, concerns around the war in Eastern Europe, high inflation and hawkish central bank policy had cheapened valuations more meaningfully, versus US preferreds. This extra risk demands slightly more potential reward for investors.

Quality control

Like mainstream bonds, preferreds come at different levels of credit quality.

Investment-grade (IG) preferreds – the higher quality or more creditworthy ones – offer a yield premium over US Treasuries of 240bps.

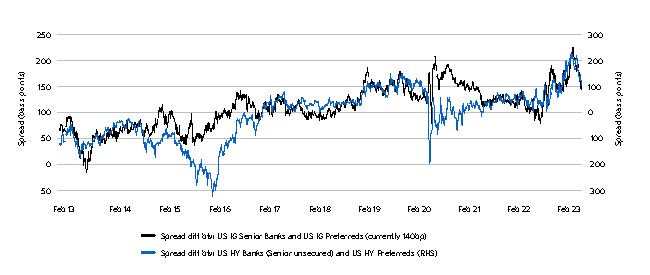

And the premium over senior unsecured bank debt is 125bps, compared to a 20-year average closer to 90bps – figure 1. At the lower quality end, the yield premium over Treasuries on the high-yield (HY) preferred index is roughly 350bps.

Compared to standard high-yield corporate bonds – as measured by the BB-rated high-yield bond index – the yield premium is 100bps. Again, this is much higher than the two-decade average.

In short, US preferreds appear relatively cheap to senior unsecured corporate bonds, both IG and HY.

Figure 1. Preferred valuations have cheapened versus corporates

Source: Bank of America and Bloomberg, as of 13 Feb 2023. Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment. Index returns do not include any expenses, fees or sales charges, which would lower performance. Past performance is no guarantee of future results. Real results may vary. Chart shows spread (difference in yield) between US and HY investment-grade banks (senior unsecured) and US IG and HY preferreds, as measured by the Bloomberg Barclays IG Bank Index, Bloomberg Barclays BB-rated HY Index, ICE BofA US IG Capital Securities index and ICE BofA US HY Capital Securities Index.

Preferred scarcity is good for pricing

There have been supply shortages in the preferred securities market for several years. With most banks fully capitalized, they’ve had much less need to raise Tier 1 capital – the core reserves banks use to fund their services – by issuing preferreds.

Indeed, the lion’s share of new preferred issuance in recent times was primarily for refinancing purposes only. In 2022, an already small asset class – market value of only $550bn – got even smaller.

Including both $1,000 and $25 par markets throughout the US and Europe, new preferred supply last year came in at around $41.5 billion. This was a decline of 60% versus 2021. Redemptions – issuers paying back investors – exceeded this amount by roughly $3.5 billion.

So, what next for preferred supply?

The 2023 supply outlook isn’t easy to predict, but we do not see it likely to change much from prior years.

After all, most banks remain well capitalized, so we may again see more preferreds leave the marketplace than enter it.

If global yields fall from current levels, as we suspect they may, and investors hunt around for higher yields, the preferred market may yet again face the old bond market adage of “too much cash chasing too few bonds.”

Expected returns and recessions – is the worst behind us?

There are, of course, risks to our view. One of them is potential recession in 2023.

What does history tell us about preferreds in recessions? Well, index data for preferreds only goes back about four recessions, much less than for many other assets.

But based on the record we do have, preferred performance going into and during recessions has been weaker than thereafter – figure 2.

That said, holding preferreds throughout recessions has paid off – except in the dire conditions of the Global Financial Crisis of 2007–09.

We don’t expect any recession in 2023 to be anywhere near as bad. If anything, the banking system today would be going into a potential economic slowdown in good shape. Thanks to the strict regulatory environment, balance sheets have had to become much healthier.

And since the potential recession may prove to be the most widely anticipated downturn in living memory, the damage to the preferred market may have already been done.

FIGURE 2. PREFERRED RETURNS (%) DURING RECESSION PERIODS

| %-Based Returns | ||||||

|---|---|---|---|---|---|---|

| Recession periods | 6m prior | 3m prior | During | 3m post | 6m post | Full return |

| July 1990 - March 1991 | (1.9) | 9.0 | 11.3 | 4.1 | 12.6 | 22.8 |

| March 2001 - November 2001 | 6.6 | 4.2 | 7.1 | 1.5 | 2.0 | 16.4 |

| December 2007 - June 2009 | (9.0) | (6.2) | (26.0) | 12.3 | 16.7 | (21.4) |

| February 2020 - April 2020 | 4.3 | 2.1 | (3.9) | 4.9 | 6.0 | 6.2 |

| Average | (0.0) | 2.3 | (2.9) | 5.7 | 9.3 | 6.0 |

| %-Based Returns | ||||||

|---|---|---|---|---|---|---|

| Recession periods | 6m prior | 3m prior | During | 3m post | 6m post | Full return |

| March 2001 - November 2001 | 9.2 | 10.8 | 11.5 | 1.2 | 3.8 | 24.6 |

| December 2007 - June 2009 | (2.4) | (1.4) | (24.0) | 17.0 | 24.0 | (9.2) |

| February 2020 - April 2020 | 6.0 | 2.6 | (4.9) | 6.5 | 8.0 | 8.9 |

| Average | 4.3 | 4.0 | (5.8) | 8.2 | 12.0 | 8.7 |

Source: Bank of America, as of 3 Jan 2023. Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment. Index returns do not include any expenses, fees or sales charges, which would lower performance. Past performance is no guarantee of future results. Real results may vary. Table shows index returns for $25 par exchange-traded preferreds and $1,000 par institutional capital securities through recession periods. Indices used are the ICE BofA Core Plus Fixed Rate Preferred Security Index and ICE BofA US IG Capital Securities Index.

Why we are positive on preferreds

Given the technical support and their valuations, we think preferreds have the potential for a continued turnaround in 2023.

Not to mention, substantial down years like 2022 have always been followed by up years – figure 3.

Admittedly, past performance is no guarantee of future returns. What’s more, we acknowledge the potential for spreads to widen if the macroeconomic outlook worsens.

If we assume a current yield of 6% – or what we’d earn on interest over the full year – Citi Global Wealth Investments’ view on lower rates could add another 2% in price return.

If spreads remain unchanged, we believe high single-digit total returns are on the table for preferreds in 2023.

If spreads rally, a bullish outcome could push performance into the low double digits. Conversely, if spreads widen, this may offset any benefit from the decline in interest rates.

Bottom line: we believe positive returns are in store for preferreds in 2023.

FIGURE 3. HISTORY SUGGESTS BOUNCE-BACK POTENTIAL AFTER A DOWN YEAR

Source: Bank of America, as of 3 Jan 2023. Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment. Index returns do not include any expenses, fees or sales charges, which would lower performance. Past performance is no guarantee of future results. Real results may vary. Table shows annual returns in the ICE Bank of America IG Capital Securities Index since 1997.

Preferred Securities: Interest payments on certain issues may be deferred by the issuer for periods of up to 5 years. The investor would still have income tax liability even though payments would not have been received. Price quoted is per $25 share, unless otherwise specified. The majority of preferred securities are "callable" meaning that the issuer may retire the securities at specific prices and dates prior to maturity. Some preferred securities are QDI (Qualified Dividend Income) eligible. Information on QDI eligibility is obtained from third party sources. The dividend income on QDI eligible preferreds qualifies for a reduced tax rate. Many traditional 'dividend paying' perpetual preferred securities (traditional preferreds with no maturity date) are QDI eligible. In order to qualify for the preferential tax treatment all qualifying preferred securities must be held by investors for a minimum period - 91 days during a 180-day window period, beginning 90 days before the ex-dividend date. Prices may fluctuate reflecting market interest rates and the issuer’s credit status.